can you mobile deposit a money order

Money orders are not allowed in the US. When cashing in person youll need a valid form of identification such as a drivers license or passport.

|

| Mobile Check Deposit Limits At The Top U S Banks Of 2021 Mybanktracker |

Some banks require you to hand the physical document over for processing.

. There is a fee of 374 to deposit up to 1000. Some banks will also allow you to deposit money orders by mailing them to the bank by depositing them in an ATM or even by taking a photo of the money order with your smartphone. Helpful technology that saves you time and keeps you in the know. Present the original money order to the teller.

I rarely receive payment by money order so this is pretty new to me. Provide a government-issued ID. Banks that allow Money Order deposits via Smartphone Allow MO deposits via Smartphone. September 14 2012 Before snapping photos of her money order with Bank of.

Central daily cutoff time the next day as well as the previous six calendar days will be included in. Can You Mobile Deposit A USPS Money Order. Some traditional financial institutions may allow you to put money orders through mobile or electronic deposit while others will not. This means that if you have a valid account at a bank and someone has written you a money order then you may.

However if youre used to depositing checks into your bank account remotely using your mobile phone you might not be able to do that with a money order. Dont forget that youll probably face some service fees to cash the money order. Some dont even let you mobile deposit any money order. No Mobile Deposit is a no charge service which allows you to deposit checks into your Capital One eligible checking savings and money market accounts without trips to the branch or ATM.

It looks like most banks allow checks AND money orders to be deposited through their individual bank mobile apps. And if you use an online-only bank you may not be able to deposit a money order at all. Yes mobile deposit is possible in a money order. The minimum deposit is 20.

Using the EQ Bank mobile app you can deposit up to 100000 per cheque. Youre correct but in the mobile app I can either take a picture of the pictures of the money orders or print the images and take a picture. If you make a deposit after the 900 pm. You can deposit funds if your debit card is issued by one of over 15000 financial institutions in the US.

Because they are not considered a form of payment. Good question we all know that CHECKS can easily go through most mobile apps to most banks but money orders are a little different. You just bring in a money order with you. What Day Does Unemployment Deposit Money In NY.

Sign endorse the money order in front of the teller. Paperless statements Digitally access up to 7 years of statements. Bank Of America Mobile App Says Money Orders Are Allowed Rejects My Money Order Deposit by Laura Northrup Last updated. 1000 per day 3000 per month.

You can deposit a money order made out to yourself or cash it at your bank. Account alerts Set up alerts to monitor your balance deposits and more. Provide your account information signature card ATM card debit card or deposit slip. In most cases you would deposit the money order into your Chase Bank account just like you would with any check.

You can earn money from the EQ Bank Referral Program. For direct deposit you have to login with your NY. To see your daily maximum deposit amount logon to the USAA Mobile App and select Deposit As a reminder the deposit limit is the maximum aggregate amount you can deposit into all of your accounts of which you are an owner. According to Chase Bank customer support you can deposit money orders with your Chase Bank account through an ATM in-person at a Chase Bank branch location or by using the Chase Bank mobile app.

Opens Overlay Chase text banking Check balances and transaction history with a text. Mobile deposit is a part of electronic transaction that you can perform from your mobile phones and other systems. Yes you can all you have to do is check whether your bank allows you that facility. Go to your local branch.

There are many like Alliant Credit union Citibank HSBC KeyBank TD bank and US bank. Are money orders the same as checks. You can deposit it into your account online or by calling a hotline. When youre ready to cash or deposit a money order endorse the back just like you do a check.

You can also deposit money to your bank debit card at a Walmart location either at a register the MoneyCenter or customer service center. Postal money orders remotely created checks whether in paper form or electronically created convenience checks checks drawn against a line of credit non-American Express travelers checks cash checks that are illegible or contain MICR data that is not machine-readable and. The following are not eligible for Mobile Deposit. Some banks dont have that option quite yet but it looks like banks are adding this service more and more so if.

Banks dont let you mobile deposit USPS money orders. This is typically on the back but the teller can help you find the endorsement line. You do not need to give your account number or your password. Which banks do not allow mobile deposit money orders.

Charles Schwab depending on account up to 10kday While they allow MOs their app may not be able to read all MOs. You can still deposit via ATM or in person. Oversized or undersized checks such as rebate checks may not be accepted via mobile deposit. What banks and credit unions allow mobile deposit money orders.

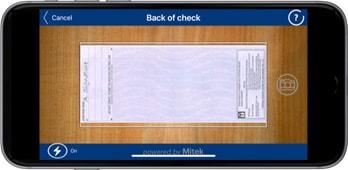

Mobile Check Deposit will only accept standard-sized personal or business checks. Doesnt seem to take MoneyGram. Photo deposits can be difficult though because its hard to capture the image thanks to security features printed on money orders. There are a few different ways to deposit a money order though in general it can be deposited much like a check or cashier s check from a bank.

Some banks like Citibank Wells Fragoallow this mobile deposit for the money order. Can I deposit my own money order. Your weekly deposit limit is defined as the maximum amount you can deposit using your mobile device every 7 calendar days which includes the current calendar day and the previous 6 calendar days. It may be necessary to cash a money order before deposit if a bank does not allow the deposit of money orders.

|

| Mobile Deposit First National Bank |

|

| Mobile Deposit The State Bank Group |

|

| Mobile Check Deposit Keybank |

|

| Mobile Deposit First National Bank |

|

| Make Mobile Deposits Wells Fargo |

Posting Komentar untuk "can you mobile deposit a money order"